In this multi-sector series, we delve into the pressing issue of inflation in Nigeria, exploring its impact across three crucial pillars of economic development: agrifood, infrastructure, and production. Inflation in Nigeria has been a persistent challenge, affecting various sectors of the economy and the livelihoods of its population. Over the years, Nigeria has experienced high inflation rates, driven by factors such as currency devaluation, rising food prices, and supply chain disruptions. The country’s heavy dependence on imports for essential goods and the vulnerability of its economy to global market fluctuations further contribute to inflationary pressures, eroding the purchasing power of consumers and posing significant challenges to businesses, investment, and economic stability. This article, the first in the series, explores food importation as a key driver of food inflation in Nigeria. The following article will discuss how infrastructural challenges are limiting the capacity of major sectors in the country, and the final article in the series will examine the production capacity of goods and services in Nigeria.

Africa’s vast population, rich biodiversity, large uncultivated arable land and vibrant markets give it a potential edge over other continents in food production and supply. Data shows that the continent has the capacity to conveniently feed itself, and over 60% of the world population by 2050; yet the recent global food inflation trend lists several African countries, including Nigeria among those facing acute food inflation. Indeed, food inflation is currently a global challenge with Nigeria, Africa’s potential agricultural powerhouse, ranking 11th in global food inflation alongside Lebanon, Venezuela, Zimbabwe, and Haiti.

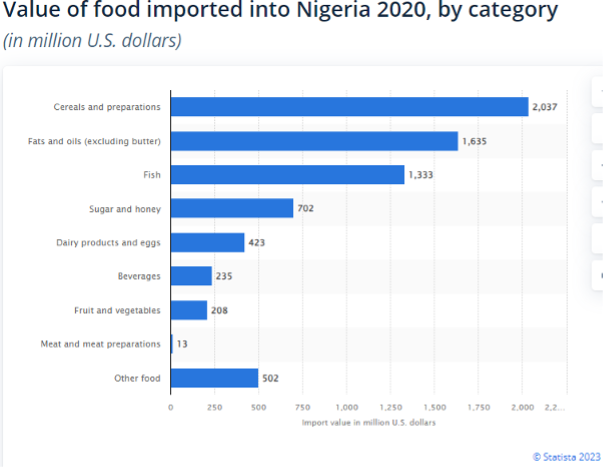

Food inflation, simply put, is an increase in the price of food. In research conducted across 15 African countries including Nigeria, the International Monetary Fund (IMF) found that changes in the global food index, in addition to heavy dependence on food importation and unstable foreign exchange rate are key drivers of food inflation in the region. This depicts the situation in Nigeria. Amid high foreign exchange rates and severe headline inflation, food importation alone accounted for roughly N1.9 trillion of Nigeria’s total imports in 2022; a 5% increase of the total amount spent on food importation the previous year. According to Statista, in 2020, Cereals and preparations importation accounted for $2,037 million, Fat and oils account for $1,635 million, fish, sugar, dairy food and beverages account for $1,333 million, $702 million, $423 million and $235 million respectively (see the chart below).

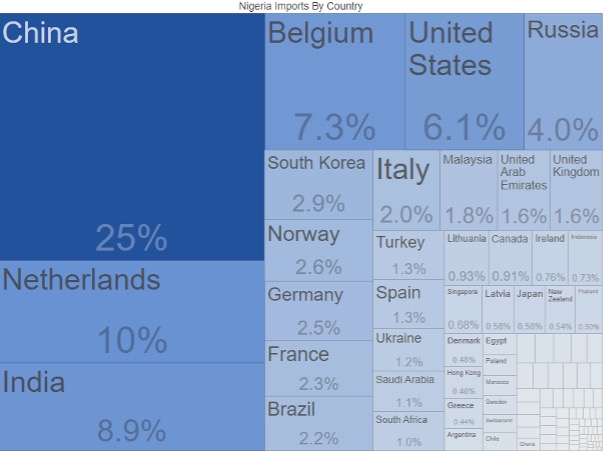

Interestingly, the raw materials required for the production of these imported agrifoods are also produced on Nigerian farms in large quantities. Firstly, cereals are produced mainly from corn, rice, wheat, oats and barley etc. In addition to being the largest producer of rice in Africa, producing about 8,435,000 tonnes annually, Nigeria has about 34 million hectares of arable land area with grains being some of its major crops. Secondly, fats and oil are produced from plants such as palm, soybean, olives, cottonseed, sunflower seeds etc and animals. Despite being the 5th world’s largest palm oil producer and the largest producer of soybean in sub-Saharan Africa, 30 Nigerian states have the climate and soil to produce sunflower seed. Thirdly, Nigeria is a maritime state with 9 of its 36 federal states including Ogun, Lagos, Ondo, Edo, Delta, Bayelsa, Rivers, Akwa Ibom, and Cross Rivers States having a coastline in the Atlantic Ocean. Hence, Nigeria’s heavy dependence on food importation from China, Netherlands, India, Belgium etc (see chart below) is not subject to inadequacy to self-produce, and several other factors that include: farmers’ inadequate access to finance, inadequate storage facilities and poor food preservation techniques, insecurity challenges for farmers in rural areas, unaffordability of modern farming equipment by smallholder farmers, lack of modern agricultural education etc. However, the absence of enabling agrifood strategies, initiatives, and policies by the Nigerian government underpins these problems.

Interestingly, the raw materials required for the production of these imported agrifoods are also produced on Nigerian farms in large quantities. Firstly, cereals are produced mainly from corn, rice, wheat, oats and barley etc. In addition to being the largest producer of rice in Africa, producing about 8,435,000 tonnes annually, Nigeria has about 34 million hectares of arable land area with grains being some of its major crops. Secondly, fats and oil are produced from plants such as palm, soybean, olives, cottonseed, sunflower seeds etc and animals. Despite being the 5th world’s largest palm oil producer and the largest producer of soybean in sub-Saharan Africa, 30 Nigerian states have the climate and soil to produce sunflower seed. Thirdly, Nigeria is a maritime state with 9 of its 36 federal states including Ogun, Lagos, Ondo, Edo, Delta, Bayelsa, Rivers, Akwa Ibom, and Cross Rivers States having a coastline in the Atlantic Ocean. Hence, Nigeria’s heavy dependence on food importation from China, Netherlands, India, Belgium etc (see chart below) is not subject to inadequacy to self-produce, and several other factors that include: farmers’ inadequate access to finance, inadequate storage facilities and poor food preservation techniques, insecurity challenges for farmers in rural areas, unaffordability of modern farming equipment by smallholder farmers, lack of modern agricultural education etc. However, the absence of enabling agrifood strategies, initiatives, and policies by the Nigerian government underpins these problems.

Also, the minimum wage in Nigeria is currently N30,000 (US$72), and about 90% of the country’s working population already spends at least 60% of their income on food consumption. Thus, the recent surge in food prices across the nation resulted in acute food insecurity and extreme poverty for almost 63% (133 million) of the population. The 2023 edition of the Global Report on Food Crises(GRFC) announced that about 258 million people across 58 countries including Nigeria faced acute food insecurity (IPC/CH Phase 3+ or equivalent) in 2022, with a possibility that more people will experience famine levels of food insecurity (IPC/CH Phase 5) in the coming years.

Also, the minimum wage in Nigeria is currently N30,000 (US$72), and about 90% of the country’s working population already spends at least 60% of their income on food consumption. Thus, the recent surge in food prices across the nation resulted in acute food insecurity and extreme poverty for almost 63% (133 million) of the population. The 2023 edition of the Global Report on Food Crises(GRFC) announced that about 258 million people across 58 countries including Nigeria faced acute food insecurity (IPC/CH Phase 3+ or equivalent) in 2022, with a possibility that more people will experience famine levels of food insecurity (IPC/CH Phase 5) in the coming years.

In conclusion, the multi-sector series on inflation in Nigeria has shed light on the factors contributing to the country’s food inflation challenges. Despite Nigeria’s immense potential for food production and self-sufficiency, heavy dependence on food imports, volatile foreign exchange rates, and global food price fluctuations have fueled inflationary pressures. The series has highlighted the need for comprehensive agrifood strategies, initiatives, and policies to address the underlying issues such as inadequate access to finance, storage facilities, and modern farming equipment. Moreover, the significant impact of rising food prices on the population’s food security and poverty levels cannot be overlooked. It is crucial for the Nigerian government to prioritize interventions that support local food production, enhance farmers’ livelihoods, and ensure affordable access to nutritious food for all. Only through concerted efforts and effective policies can Nigeria overcome its food inflation challenges and achieve sustainable food security for its people.

About the Author(s)

Olayide Oyeleke is an associate at The AR Initiative.